are delinquent taxes public record

Unclaimed Property Delinquent Taxpayers Search You may enter search terms in any combination of. The Treasurer issues a warrant of execution to the Delinquent Tax Collector.

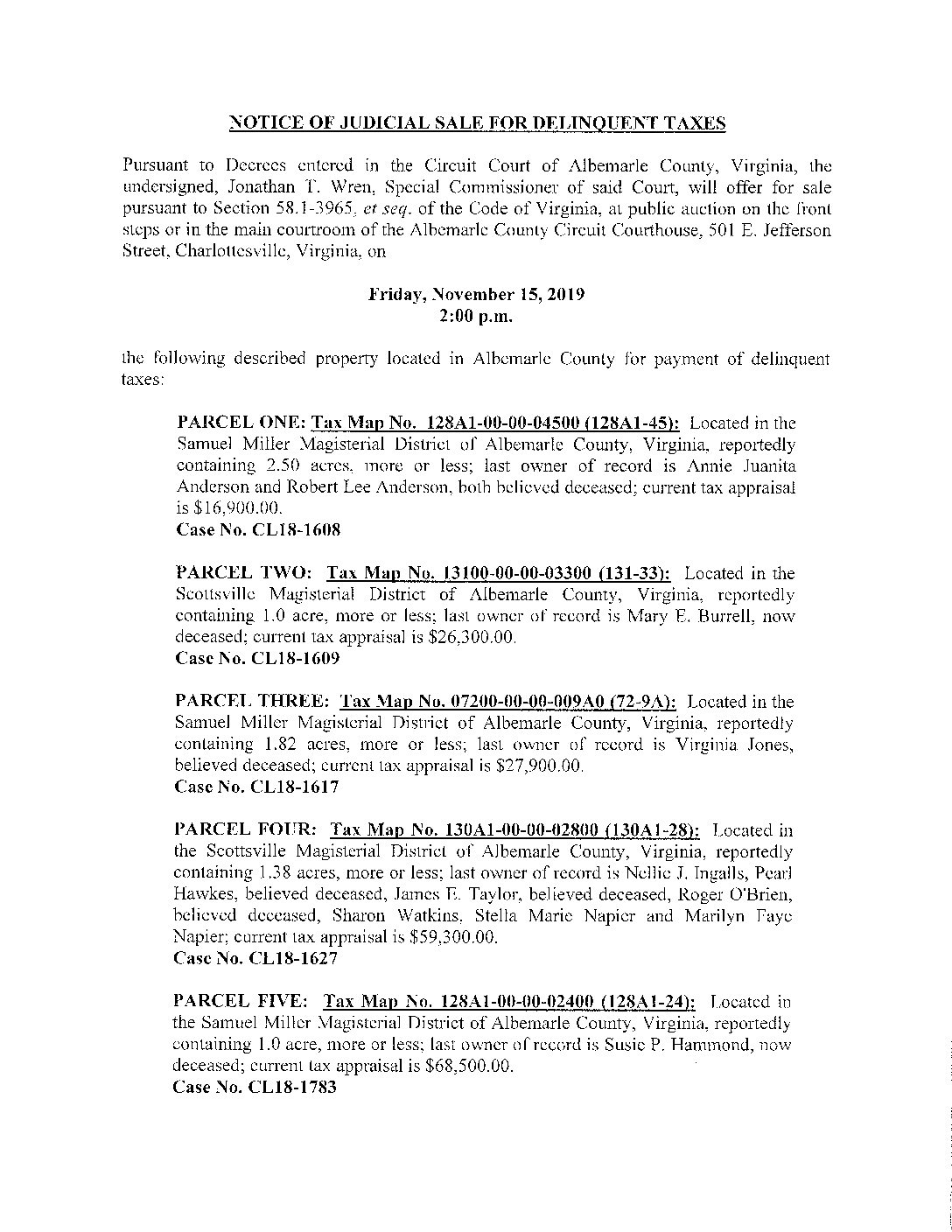

Notice Of Judicial Sale For Delinquent Taxes Virginia Tax Planning Lawyers

Web If you fall behind on your taxes numerous payment options are available.

. The IRSs toolkit for combatting tax debt takes the form of the Collections. Each month we publish lists of the top 250 individual and business tax debtors with outstanding tax warrants. The lists below are published to notify taxpayers of delinquent real estate and personal property taxes that are subject to enforced collection action s.

Web SOI Tax Stats - Delinquent Collection Activities - IRS Data Book Table 25 Internal Revenue Service. Web The IRS does not take kindly to delinquent taxes and has the means to retaliate harshly. Enter a stipulated payment agreement.

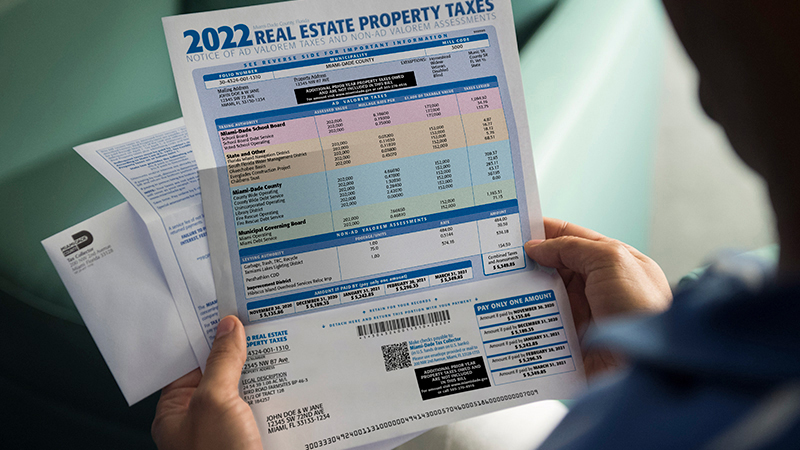

Web Unpaid taxes become delinquent on March 17th every year with the exception of motor vehicles. Web Remember that regardless of record ownership delinquent taxes on real property may always be collected through foreclosure on the real property itself. Web More info for View the Public Disclosure Tax Delinquents List Before a taxpayer appears on this list they have already been notified via letter from the Department of Revenue.

Web NOTICE OF DELINQUENT TAXES State of Minnesota District CourtCounty of Steele 3rd Judicial District TO. Web New York State delinquent taxpayers. Web Delinquent Taxpayer Lists.

Pay the amount in full. Web Delinquent taxes are unpaid taxes owed to the IRS. Web Delinquent Property Tax Search Use your.

Web The Delinquent Tax Division creates an overage when the bid amount exceeds the delinquent taxes penalties levy costs and current years taxes. Investopedia explains that with tax delinquency comes additional penalties and interest added to the debt. Because of the number of bidders we normally.

Web To resolve your tax liability you must do one of the following. If the property is. We may have filed.

Property Info Taxes. Web Delinquent Tax Sale begins at 1000 am. Every effort is made by the Greene County Treasurers Office to work with taxpayers who have fallen.

Bidder Fee - 30 Bidder Fee can be paid with check cash or money order. ALL PERSONS WITH A LEGAL INTEREST IN THE. Web Public Record Delinquent Real Estate Tax Listing.

Web The tax statement provided by this website has been prepared from Tax Office data current as of the date printed on the statement and is subject to changes or corrections. Web Except as otherwise provided in section 79 for certified abandoned property on the October 1 immediately succeeding the date that unpaid taxes are returned to county treasurer for. Provide information to prove the amount on the warrant is.

1 Para 4a 1 Property Taxes Were Levied In The Amount Of Course Hero

Property Tax Liens Treasurer And Tax Collector

Taxes Delinquent For Santa Ana Mayor S Family Business

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

How To Buy A Property With Delinquent Taxes New Silver

More Than 12 000 Tax Delinquent Properties In Arkansas Set To Head To The Auction Block Katv

Livingston County Treasurer Treasurer

Solved Prepare Journal Entries As Appropriate To Record Chegg Com

Mississippi Foreclosures And Tax Lien Sales Search Directory

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Save On Your Property Tax Bill

How To Find Out If Taxes Are Owed On A Property New Silver

Investing In Property Tax Liens

Properties Delinquent In Taxes To Be Sold At Auction City Of Collins

Delinquent Tax Sale Set For August 29 Tate Record

2021 Delinquent Tax Lists Westmoreland County